🏡 Florida First-Time Homebuyer Guide

Low & No Money Down Edition

Presented by Darron Burow, REALTOR®

Florida Homes Realty and Mortgage • 321-914-2347 • www.darronburow.com

👋 Welcome!

Buying your first home can feel like a big step — especially when you’re wondering how much cash you need to save. The good news? You don’t need 20% down. In fact, you may be able to buy a home in Florida with little or even no money down, and in many cases, with help covering your closing costs.

This guide will walk you through:

- Florida-based loan programs and grants

- How to potentially buy with no money out of pocket

- The real numbers behind owning vs. renting

- What to expect — and how I’ll help you every step of the way

💡 Can I Really Afford to Buy a Home?

Here’s the truth:

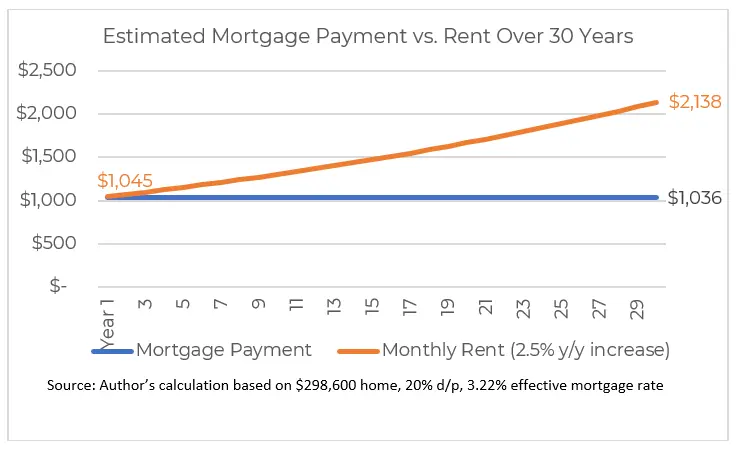

If you can afford your rent, you can likely afford a mortgage.

In fact, buying a home with a fixed-rate loan locks in your monthly payment, while rent continues to go up year after year.

💰 Low & No Down Payment Loan Options in Florida

- FHA Loan – 3.5% down, flexible credit

- VA Loan – 0% down (for veterans, military, and some spouses)

- USDA Loan – 0% down in eligible areas

- Conventional 97 Loan – 3% down, low PMI

💡 Bonus: Many of these programs allow gift funds or work hand-in-hand with down payment assistance.

🎁 Florida Down Payment Assistance

✅ Florida Hometown Heroes (Up to $35,000)

- For teachers, nurses, law enforcement, military, and over 100 other professions

- Full-time employment with a Florida-based employer required

- Forgiven after 5 years in the home

✅ Florida Assist (Up to $10,000)

- 0% interest second mortgage

- Repaid only when you move, refinance, or sell

🔑 Seller-Paid Closing Costs: A Powerful Advantage

If saving for closing costs is holding you back — here’s the good news:

➡️ It is completely possible to ask the seller to cover part (or even all) of your closing costs.

When we negotiate your offer, I can help structure it in a way that reduces your cash due at closing — often to just the down payment, or even less if paired with assistance programs.

📌 Imagine: With the right structure, you could get into your new home with only a few thousand dollars — or less.

🛠️ What You’ll Need to Get Started

- Recent pay stubs and W-2s

- Tax returns from the last 2 years

- Bank statements

- Valid photo ID

- A great real estate agent (✅ that’s me!)

🤝 I’m With You Every Step of the Way

This isn’t just a download and “good luck” — once you grab this guide:

➡️ I will personally follow up with you to answer any questions you may have

➡️ You’ll get direct access to trusted lenders, including those who specialize in low/no money down options

➡️ I’ll help you understand what you actually qualify for — with no pressure or obligation

This is a real conversation — not a sales pitch.

📍 Local Expertise Matters

As a Florida-based agent, I know which neighborhoods qualify for certain programs, which price ranges work for Hometown Heroes, and which lenders go the extra mile for first-time buyers.

Whether you’re buying in:

- Satellite Beach

- Melbourne

- Brevard County

- Or anywhere along the Space Coast

I’ll help you make smart, informed decisions.

📞 Ready to See What You Qualify For?

You might be much closer than you think — and the first step is simple. I’ll be reaching out to you soon to answer your questions. Reach out to me now

📲 Call/Text Darron Burow at 321-914-2347

💬 Or email: [email protected]

Stop paying your landlord’s mortgage.

Let’s explore how to make homeownership happen — without draining your savings.